The “Black Friday” Panic of 1869, a financial scandal that shook the United States and tainted the presidency of Ulysses S. Grant, remains a significant episode in American economic history. Orchestrated by a pair of ambitious financiers, Jay Gould and James Fisk, this scandal revolved around a scheme to manipulate the gold market for personal gain. The fallout from the panic exposed vulnerabilities in the financial system and highlighted challenges in Grant’s administration. This article delves into the details of the scandal, its impact, and the role of Grant’s presidency in the unfolding crisis.

The Origins of the Gold Scandal

In the late 1860s, the U.S. economy was still adjusting to the post-Civil War era. The country faced a burgeoning financial market, with gold playing a central role in economic transactions and investment. Jay Gould and James Fisk, two prominent financiers, saw an opportunity to profit by manipulating the gold market.

Gould and Fisk devised a scheme to drive up the price of gold by creating an artificial scarcity. They began purchasing large quantities of gold, with the aim of driving up its price through speculation. Their strategy relied on influencing market perceptions and leveraging political connections to support their goals.

The Role of the Grant Administration

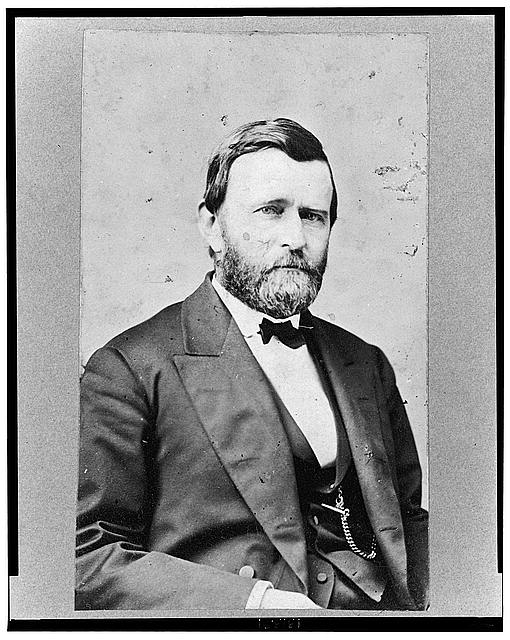

Ulysses S. Grant, having been elected president in 1868, was relatively inexperienced in financial matters and surrounded by a mix of capable and corrupt officials. Grant’s administration, while focused on Reconstruction and civil rights, was ill-prepared to handle the complexities of the financial manipulation that was about to unfold.

In the months leading up to the panic, Gould and Fisk were able to secure some level of support from certain government officials, which further fueled their speculative activities. Their scheme involved covertly pressuring the Treasury Department to withhold gold from the market, thereby increasing its price.

The Panic Unfolds

The critical moment came on September 24, 1869, a day that would later be known as “Black Friday.” On this day, Gould and Fisk’s scheme was on the brink of success. They had managed to drive up the price of gold significantly, and their speculation had created an environment of financial tension.

However, their plans were thwarted when the U.S. government, under the direction of Treasury Secretary George Boutwell, decided to intervene. Boutwell, aware of the escalating speculation and the threat it posed to the stability of the currency, ordered the release of gold reserves to stabilize the market. This decision was crucial in reversing the manipulation and restoring some level of order.

The Immediate Aftermath

The release of gold reserves triggered a dramatic collapse in the gold market. The price of gold plummeted, leading to a wave of panic among investors and traders who had been caught in the speculative frenzy. Financial institutions and individuals who had invested heavily in gold suffered substantial losses.

The collapse had far-reaching effects on the broader economy. The financial instability exacerbated economic uncertainty and contributed to a downturn in the stock market. The panic also led to a loss of confidence in the financial system, as it became clear that market manipulation and corruption were serious concerns.

Public and Political Reactions

The fallout from the gold scandal was immediate and intense. Jay Gould and James Fisk were widely criticized for their unethical practices, and their reputations were severely damaged. Both men faced public scrutiny and legal challenges, although their financial resources allowed them to escape the most severe consequences.

President Ulysses S. Grant, though not directly involved in the scheme, faced political fallout from the scandal. The incident highlighted weaknesses in his administration’s handling of economic matters and raised questions about the integrity of his administration.

Grant’s administration was already dealing with various scandals and issues of corruption, and the gold scandal further eroded public trust. The perception that the administration was unable to effectively manage the financial system contributed to broader criticisms of Grant’s presidency.

Grant’s Response and Legacy

In the wake of the scandal, Grant took steps to address the damage and restore confidence. He publicly denounced the actions of Gould and Fisk and worked to distance his administration from the scandal. However, the damage to his presidency was significant, and the scandal remained a blemish on his record.

Grant’s administration faced ongoing criticism for its handling of financial and administrative matters. The gold scandal underscored the need for greater oversight and reform in the financial sector. The episode also highlighted the challenges faced by presidents who were not deeply versed in economic issues.

Despite the controversy, Grant’s presidency was notable for other achievements, including efforts in Reconstruction, civil rights advancements, and the promotion of a strong Union. The “Black Friday” Panic of 1869, however, served as a stark reminder of the complexities of financial governance and the impact of corruption on public trust.

Conclusion

The “Black Friday” Panic of 1869 remains a significant chapter in the history of U.S. financial scandals. The scheme orchestrated by Jay Gould and James Fisk revealed the vulnerabilities in the financial system and exposed the challenges faced by President Ulysses S. Grant’s administration. While Grant was not directly involved in the manipulation, the scandal had a lasting impact on his presidency and highlighted the need for reform in financial governance.

Grant’s response to the crisis and the subsequent efforts to restore confidence in the administration were important, but the scandal left a mark on his legacy. The events of Black Friday underscored the importance of transparency, integrity, and effective oversight in financial matters, lessons that continue to resonate in the realm of American politics and governance today.